do you have to pay taxes when you sell a used car

If youre leasing a car as a private individual through a personal lease you will be required to pay VAT value-added tax at a fixed rate of 20. Because capital gains taxes can substantially impact the value of your investment portfolio overall its wise to account for taxes in your investment strategy.

Smiley Says Come On By Family Auto Of Anderson We Ll File Your Taxes So You Can Drive It Home Used Cars Used Cars And Trucks Used Trucks

Another reason to buy a car from a private party.

. The state where you pay vehicle registration fees is the one that charges the sales tax not the state where you made the vehicle. In a nutshell the Internal Revenue Service IRS views all personal vehicles as capital assets. If you have income from the sale then technically you should pay taxes on the income.

Ad Looking To Sell Your Car. California statewide sales tax on new used vehicles is 725. BTW this works the other way too.

The answer to this question is no you do not have to pay taxes on the sale of your vehicle unless of course you actually sell your car for more than what its worth or more than the vehicles original purchase price. These are two different types of transactions when it comes to paying the sales tax. On the other hand if you are making any profit out of this car you need to indicate it in your next years tax return as a capital gain.

If this happens youll pay short-term capital gains tax at your regular income tax rate on a car you owned for one year or less. If you are buying or selling a car for the first time you may be unaware of how taxes are paid for this type of transaction. Anytime you sell an asset such as stocks bonds real estate or even your car you may have to pay capital gains tax on the profit.

In that case you have lost money on the vehicle and there are no taxes owed. Even in the unlikely event that you sell your private car for more than you paid for it special HM Revenue and Customs rules mean that you dont pay Capital Gains Tax. This is because you did not actually generate any income from the sale of the vehicle.

But these taxes are not paid to the seller. TAXESWHEN SELLING YOUR CAR Reporting a wrong purchase price is FRAUD. But most if not all people who sell to Carmax sell the car for a lower price then they paid for the car.

As a rule the amount of taxes will be. As this article indicated if youre not making any profit out of your used vehicle by comparing its original value to the selling value you dont need to pay any tax returns. Buying a car may be done through a car dealer or from a private seller.

A profit on a sale is bad tax-wise because youll have to pay tax on it. Income Tax Liability When Selling Your Used Car. Answered by Edmund King AAPresident.

First theres always the option to buy a car in another state to avoid sales tax. If you purchase your used car from a private seller you and sometimes the seller must handle these transactions on your own. The tax owed is due at the time that the transfer of the vehicle registration.

The monthly rental payments will include this additional cost which will be spread across your contract. In every province except Alberta you have to pay provincial sales tax when you buy a used car. Youll avoid earning a taxable profit if you trade in your car instead of selling it.

Some areas have more than one district tax pushing sales taxes up even more. However you do not pay that tax to the car dealer or individual selling the car. DMV Fees Generally a dealership will help you deal with DMV-related fees such as your title transfer fee and registration fee.

When it comes time to calculate your total income to report on your 1040 form you need to include all the money youve been paid. If you sell a 2017 Mercedes and claim a sale price of 15000 or less you will have to pay tax on the 15000 or less val-uation. If you sell a used car for less than its original purchase price plus any long-term improvements the buyer may have to pay sales tax on the purchase but you wont incur a tax obligation.

Do you have to pay income tax after selling your car. The sales tax is higher in many areas due to district taxes. Is it Possible Not to Pay Any Sales Tax on Used Cars.

Unless its part of negotiations the buyer will be required to pay all. Of course you must still handle all DMV-related fees and state-mandated sales taxes. However if you sell it for a profit higher than the original purchase price or what is.

If you use your car for both business and personal driving you must pay tax on both your business and personal profit. When buying a used car from the owner do you have to pay tax. Depending on the province that means youll pay as much as 15 per cent in.

There are ways to avoid paying sales taxes on cars buying used or new but the options might not work for you. If you sell it for less than the original purchase price its considered a capital loss. When you sell your car only the portion of the selling price that exceeds the adjusted basis of the car is taxable gain.

One of the top questions that many people have when they sell their used car truck or van is if they have to pay taxes on the money from that sale. You will pay it to your states DMV when you register the vehicle. Traditionally the buyer of a car is the one concerned about paying taxes.

This means you do not have to report it on your tax return. But most buyers and sellers agree to state a lower price to the government. Keep in mind that you have to add the money that you invested in the vehicle after the purchase to the amount that you originally purchased the vehicle for.

Saying a SALE is a GIFT is FRAUD. When buying a used car privately it is important to know that there will be taxes applicable. Some owners will apply for a refund of any remaining Vehicle Excise Duty car tax on the vehicle though this is.

Buying a car or any other motor vehicle is a taxable transaction. Yes you must pay vehicle sales tax when you buy a used car if you live in a state that has sales tax. For example if your car has an adjusted basis of 5000 and you sell the car for 6000 you have a gain of 1000.

VAT-registered companies can reclaim up to 100 of the tax on vehicle payments on a business lease and on any maintenance. You dont have to pay any taxes when you sell a private car. The buyer must pay all sale taxes.

When youre purchasing a new or used car its important to understand the taxes and fees you may face. If youre selling a car for less than you paid for it you will not have to pay taxes on it. When you sell your car you must declare the actual selling purchase price.

However the scenario is different when you profit from the sale. If you are fortunate to sell a car at more than you paid you are supposed to pay a capital gains tax.

Pin By Happyautogreer On Happy Auto Sales Cars For Sale Cheap Used Cars Used Cars

Car Sale Receipt Receipt Template Doc For Word Documents In Different Types You Can Use Receipt Te Receipt Template Invoice Template Word Invoice Template

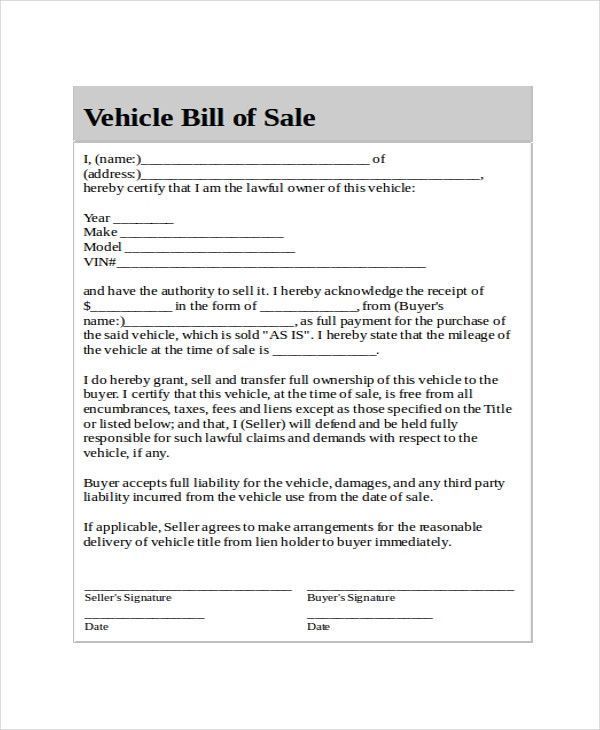

Car Bill Of Sale Printable Bill Of Sale Template Bill Of Sale Car Bill Template

Used Car Bill Of Sale Template Bill Of Sale Template Free Basic Templates Letter Template Word

This Is A Buy Here Pay Here 6825592618 All Credit Types Welcome We Sell Cars For The Low With Free Warranty And Carf We Sell Cars Cars For Sale Car

Used Car Dealer Business Plan Template Black Box Business Plans Used Car Dealer Business Plan Template Car Dealer

Bill Of Sale For Vehicle Template Bill Of Sale Template Bill Of Sale Car Bill Template

Our Car Payment Was Bigger Than Our House Payment Car Payment Smart Money Payment

Amazon Com 1976 Dodge Charger Hooked On The Looks Sold On The Price 3736 Original Magazine Ad Everything Else Dodge Charger Car Ads Dodge

Corify Wordpress Car Listings Dealership Theme Stylelib Dealership Customize Your Car Sell Car

Sold A Lemon By Tony At Salters Moorooka Car Buying Sell Car Used Car Dealer

Reduce Your Taxes To Zero The Wealthy Accountant Tax Investing Investing Money

Used Car Bill Of Sale Template Adorable Generic Bill Of Sale Template 12 Free Word Pdf Of 32 Bill Of Sale Template Templates Templates Free Design

Fillable Form Vehicle Bill Of Sale In 2021 Bills Things To Sell Types Of Sales

Unexpected Expenses Loss Of A Job Taxes Or You May Just Have Your Eye On Another Vehicle And Need To Get Rid Of Yours Old Buy Used Cars Auto Repair Used

Pin On Taxes For You Occupational Tax Help

Car Dealers Melbourne Autoline Car Sales Cars For Sale Car Dealer Best Car Deals