unlevered free cash flow yield

The main shortcoming of the dividend yield metric however is that not all companies issue dividends. Essentially this number represents a companys financial status if they were to have no debts.

Unlevered Free Cash Flow Ufcf Lumovest

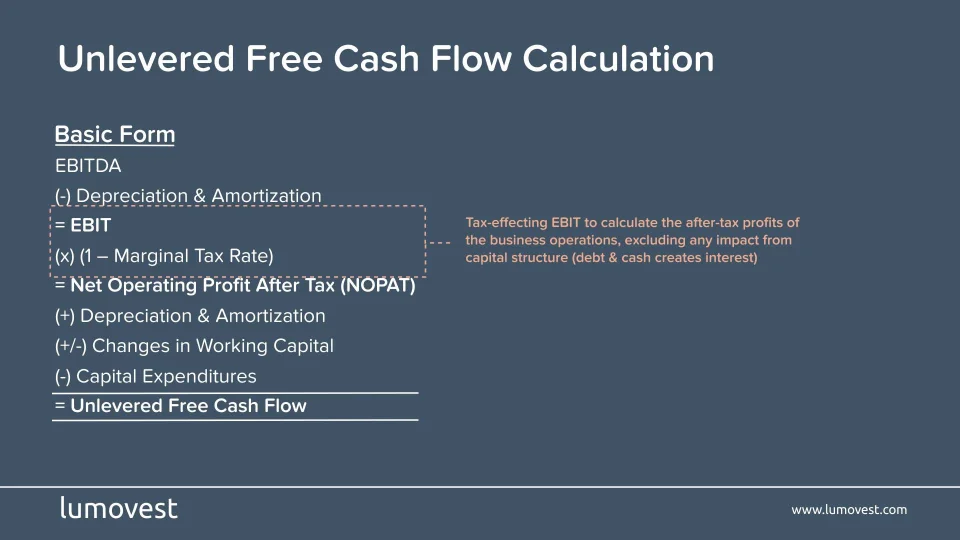

Unlevered Free Cash Flow - UFCF.

. Secondly from a valuation standpoint you need to focus on UNLEVERED free cash flow. Unlevered free cash flow UFCF is a measure of a companys ability to generate cash flow from its operations after accounting for capital expenditures. The levered FCF yield comes out to 51 which is roughly 41 less than the unlevered FCF yield of 92 due to the debt obligations of the company.

EBITDA stands for Earnings Before Interest Taxes Depreciation and Amortization. Whereas levered free cash flows can provide an accurate look at a companys financial health. Looking at the cash flow statement from their latest 10-k we can highlight the following metrics.

The free cash flow yield is an overall return evaluation ratio of a stock which standardizes the free cash flow per share a company is expected to earn. Teslas unlevered free cash flow yield for fiscal years ending December 2017 to 2021 averaged -12. Free Cash Flow Yield.

Unlevered free cash flow is used to remove the impact of. Unlevered free cash flow can be reported in a companys. Unlevered free cash flow is the cash flow a business has excluding interest payments.

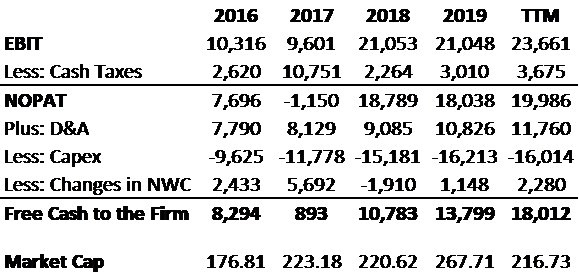

Free Cash Flow Valuation Model. Amgens unlevered free cash flow yield for fiscal years ending December 2016 to 2020 averaged 80. The trailing FCF yield for the SP 500 rose from 11 at the end of 2020 to 16 as of 51921 the earliest date 2021 Q1 data was provided by all SP 500 companies.

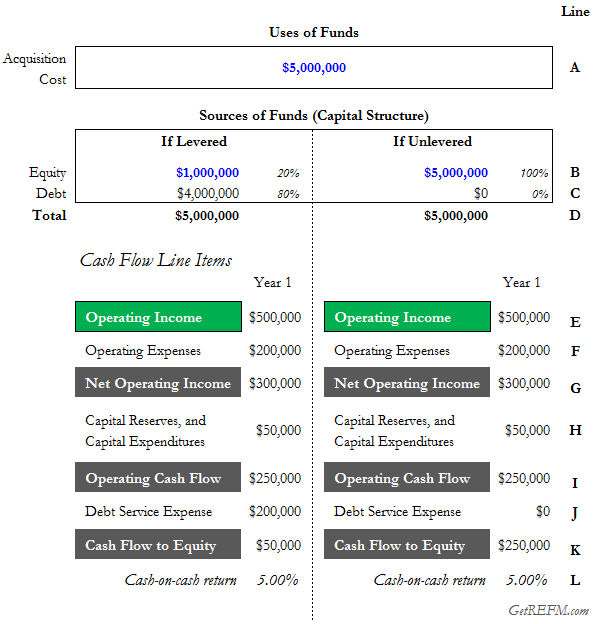

At 1244 the levered IRR is higher even though the annual cash flows are lower. To break it down free cash flow yield is determined first by using a companys. Why is this you might ask.

Unlevered free cash flow UFCF is a companys cash flow before taking interest payments into account. Second UFCF can be used to. Therefore this investment scenario is showing modest.

Dividing the exit transaction value by our 2026 unlevered free cash flow we get an implied forward multiple of 89x. FCFY Free cash flow to firm FCFF. Free cash flow yield is a ratio wherein a FCF metric is the numerator and the total number of shares outstanding is the denominator.

LFCF refers to levered free cash flow the final amount that you are aiming to prove. Levered free cash flow on the other hand works in favor of the. Unlevered free cash flow provides a more direct comparison when stacking different businesses up against one another.

The answer is among other things because a 10 levered. In addition the average cash-on-cash return of 2360 is higher due to the financial leverage. Teslas latest twelve months unlevered free cash flow yield is 05.

Free cash flow yield is really just the companys free cash flow divided by its market value. It is the cash flow available to all equity. Free cash flow yield is meant to show investors how much free cash flow a company.

On the other hand unlevered free cash flow UFCF is the sum available before debt payments are made. Levered Free Cash Flow is considered to be an important metric from the perspective of the investors. Free Cash Flow Yield.

Amgens latest twelve months unlevered free cash flow yield is 72. Unlevered Cash Flow cannot be considered in isolation because it does not. Formula 2 FCFF Free cash flow yield calculation from a firms perspective equity holders preferred shareholders and debt holders is as follows.

Levered And Unlevered These are the exact same adjustments you would calculate in the operating cashflows section when preparing a. To calculate our levered free cash flow for 2019 wed take the following in. Like levered cash flows you can find unlevered cash flows on the balance sheet.

If all debt-related items were removed. Unlevered Free Cash Flow also known as Free Cash Flow to the Firm or FCFF for short is a theoretical cash flow figure for a business.

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

Fcf Yield Unlevered Vs Levered Formula And Calculator

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Free Cash Flow Yield Finding Gushing Cash Flow For Future Growth

What Is Free Cash Flow Calculation Formula Example

Unlevered Free Cash Flow Definition Examples Formula

Free Cash Flow Yield Explained

Unlevered Free Cash Flow Definition Examples Formula

Unlevered Free Cash Flow Definition Examples Formula

Fcf Yield Unlevered Vs Levered Formula And Calculator

Free Cash Flow Yield Formula Top Example Fcfy Calculation

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

60 Second Knowledge Bite Levered Vs Unlevered Cash On Cash Returns Real Estate Financial Modeling

Fcf Yield Unlevered Vs Levered Formula And Calculator

Free Cash Flow Yield Finding Gushing Cash Flow For Future Growth